Your Child’s Tomorrow Starts Now

We’re Here to Help You Help Them

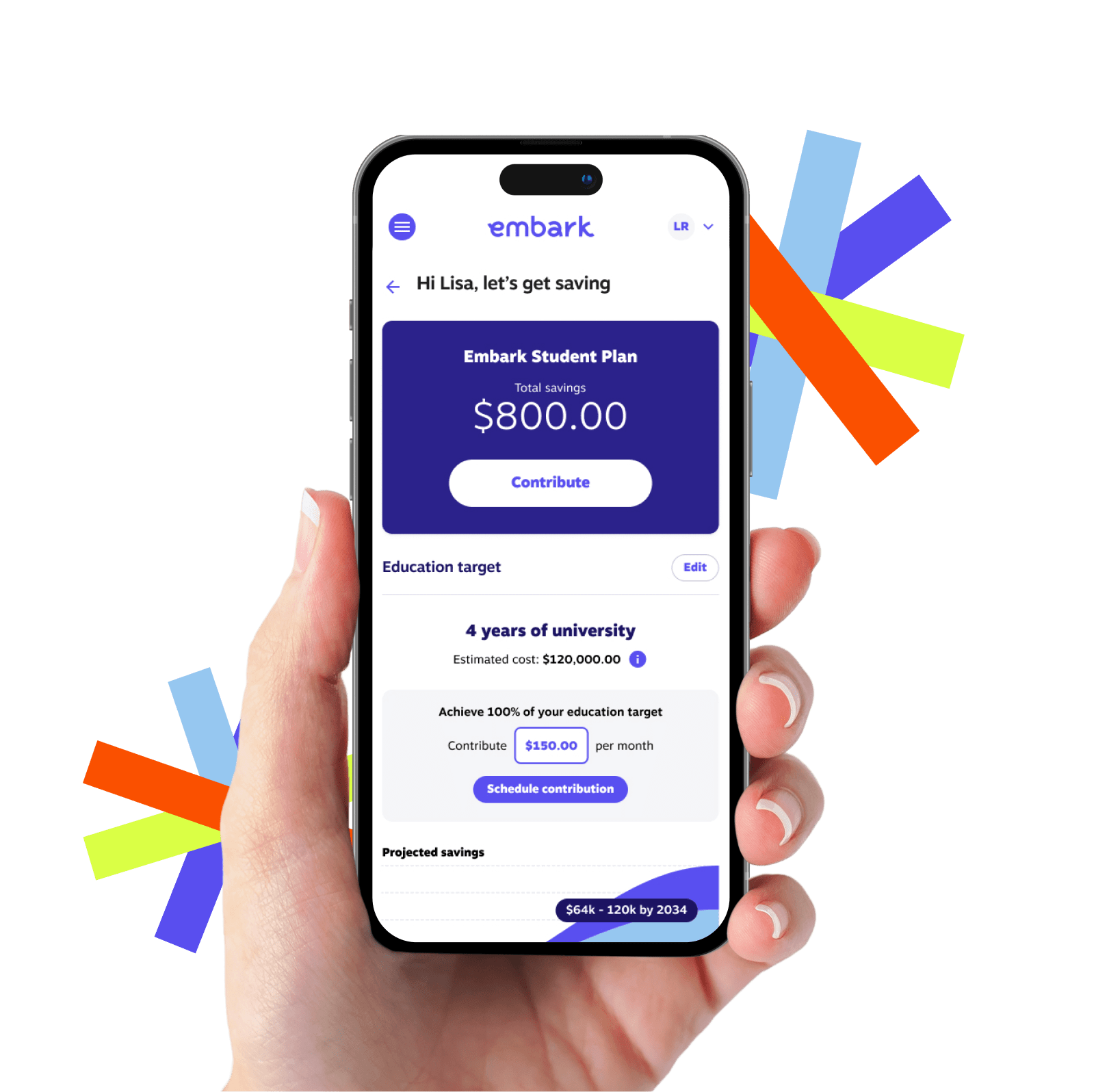

At Embark, education savings and planning is all we do. Our sole purpose is to help students realize their full potential by simplifying your savings with tools, advice, and an RESP plan that works for your family.

Saving for the Future Has Never Been Easier

- A plan that automatically adjusts to your timeline

- Simple, expert guidance helps make investing easy

- An innovative digital platform puts education savings at your fingertips

- Ability to share your plan between your children

Simplifying RESPs

Create Your Tomorrow

You and your child are moving forward together. Every step gets you closer to everything you hope for and everything they can be. The Embark Student Plan gets you closer to the place where needs and dreams align. It’s one of the most important steps you’ll take to prepare their path to the future.

60,000+

Students who have their post-secondary education costs covered every year with the help of Embark.

1.2 million+

Families and supporters who enjoy the benefits of being part of Embark.

50+ Years

Education savings and planning experience and expertise to help your child be everything they can be.

Guiding Your Education Success

Embark is owned by a not-for-profit organization. This means that all profits that aren’t used to run the business go into the Embark Student Foundation. We use these funds to provide additional financial awards that help students realize their full potential. We’ve awarded almost $57 million to families and students across the country to help with their education savings.

“Easy to access and they take care of

everything for you.”

– Lola O.

All About The Subscriber Vote

The results are in! All Flex First and Family Single Student Plan RESPs will be upgraded to the Embark Student Plan on July 1, 2024.

Learn more about the vote and change today!